Precious valuelessness: on the negative oil prices April 2020

/As you are probably well aware, in April 2020 an extraordinary situation occurred: the price of crude oil plummeted to way below zero. Let us leave the details of this occasion, the attempts at full explanations, to the analysts. In this essay I will instead do something so preposterous so as to raise the blush on my cheeks as I with trembling hands type these words: I will speculate into the outsides of price. Well, to the outsides of value.

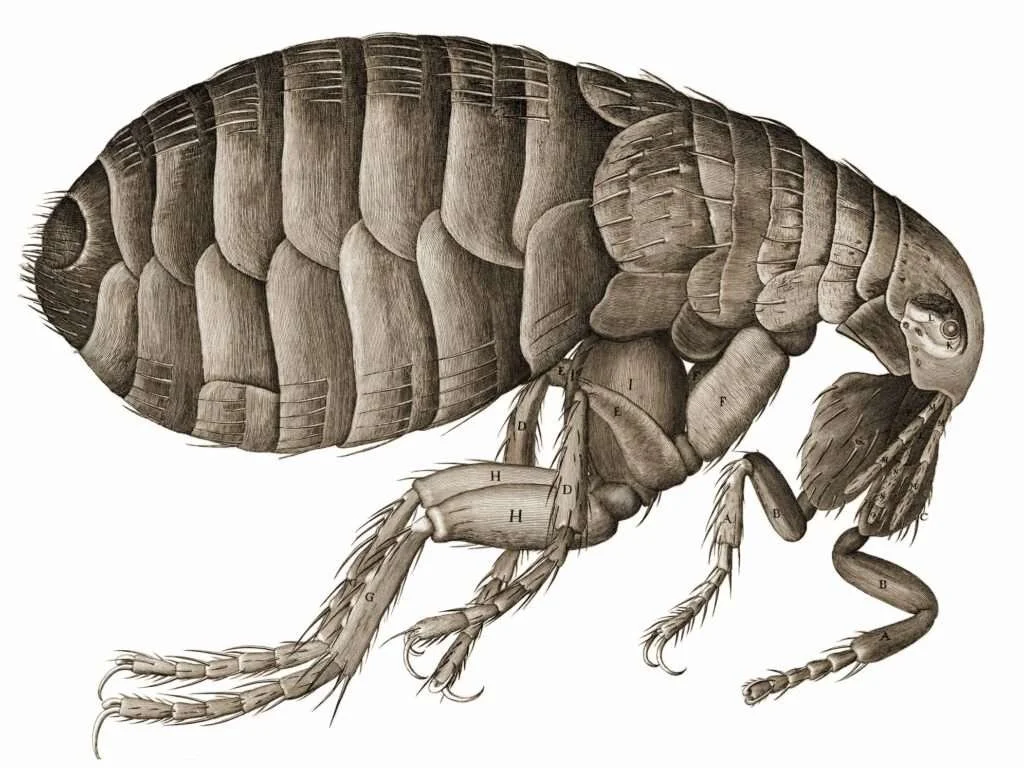

Alexander L. Kielland, Column D in the water, Details of fracture at the hydrophone

To begin with, the bare bones of the market mechanism must be spelled out. You can probably rehearse them in your sleep, however little interest you have in economics, because they have become the common sense of our world. The curves of supply and demand has received an explanatory and organizational force seldom otherwise seen, building and tearing down and rebuilding whole communities, societies, patterns of production and distribution. You know them by heart, these principles, because they take part in making up the forces by which you live. But let us rehearse these principles awake, and together. We are all market agents. Freely and rationally we evaluate what course of action to take in any given moment: evaluations which, when involving an economic transaction, are incorporated into the continuous fluctuations of market prices. In this way our individual preferences are mediated through the market mechanism: myriads of evaluative processes merge in price, which functions as a signal organizing production and distribution of scarce resources. So, when demand exceeds supply, price goes up. In reverse, when supply exceeds demand, price goes down. The market mechanism responds swiftly and efficiently to balance the contradicting forces at play in our economic reality.

Yes, one can and should object to the above harmonious description of the market. But everything has its time and its place. This is a time to allow for this logic to unfold on this blog.

As long as quantity as such exists value should as well. However much supply exceeds demand the good in question will be possible to evaluate. Mathematically speaking, positive and negative numbers are placed on a continuum. A number is positive if it is above zero, negative if below – how to determine zero differs in between conventions – but +1 and -1 are not ontologically separated. Temperature, for example, is measured on a seamless scale ranging from positive to negative. So, how come we (almost) never see negative prices? They are so unusual so as to make the very notion mind-boggling. If a price for a commodity is negative, you get paid for buying it. This is mind-boggling indeed. But it is not so in any logical sense – it is not hard to understand. It is so because it is so rare, an almost non-existing phenomenon, balancing on that exquisite edge between real world and fantasy. But a negative price just visited Earth. As all such highly unusual events, this has caused much fuzz, but few have stopped to decipher the deeper meanings of this event.

Crude oil in a brilliant way illustrates the strangeness of negative prices on our market. Before crude oil came into the manifold uses of the advanced economies in which we now live, it was little valued. Thus, for most of human history, oil had no price. Importantly though, no price does not equate negative price. The negative price of crude oil means that you get paid if you take a barrel of crude oil off the hands of a seller. Now, simply put, for this situation to occur, the balance between supply and demand must be lopsided to say the least, with heavy overweight on the supply side. There must be a production of e.g. crude oil that is significantly higher than demand, and furthermore, the unsold commodity, in this case oil, must be of a kind so as to be disturbing to keep around. If demand does not go up immediately, then production will have to shut down, or perhaps rather break down, until just enough of it remains for curves of supply and demand to meet at the plus side again. But if demand vanishes for good, then all production will stop too. That is, either the minus becomes a plus, or the commodity ceases to exist in the world of commodities. Negative prices are in this way eliminated by the mathematical simplicity of the market mechanism: furthermore, they are almost invariably eliminated before they even happen.

As the economists are well aware, however, not all things exist in the world of commodities, and the market can only respond to dollar votes. Only if you have money will you be able to affect the production and distribution of resources, and all of the interests that go beyond the individual (human) evaluation in the present moment will be left out of the equation. For example, take the air pollutions caused by traffic burning fossil fuels. Such pollution is what they call an externality. Since externalities can impede economic efficiency greatly, an institution external to the market must take care of them. The regulating government steps in, securing economic efficiency and yes, thereby the future of that system which we call capitalism. (By the way, this is exactly what is playing out with the historical actions taken to diminish the disastrous economic effects of the corona crisis. Agents transcendent to the immanent machinery of the market step onto the scene and do what they must.)

So, air pollution is an externality. But it is caused by the trade and use of a market commodity: oil. This commodity which for a brief moment saw its value drop to historical below zero levels. Price is the point of intersection between supply and demand. But when price turns negative, can we even speak of supply and demand in any ordinary sense? Isn’t negative price a moment when we see a demand for demand? As supplier I demand your demand for this product. I pay you for buying it.

It seems as though price does not follow the ordinary rules of a numerical scale. For price, when the already devastating point of zero is surpassed into the domains of the minus sign the rules of the game change or are perhaps rather made truly visible. That precious gem of demand expressed in money, which together with the productive forces allows for so much profit is for once truly treated as such, as worthy to pay for. In reality however, our demand is continuously paid for through the tiresome and unwelcome reality of commercials and ads. And more fundamentally so through the economic-political configuration of the capitalist market to begin with, where life as is canalized through this profit-generating machinery. But that falls beside my point here.

In negative price we see a brief instance of the potency of lack of demand. It is vital for the eventual (improbable) economic recovery from the present crisis that demand is not destroyed. For the last decades demand has on a global and massive scale been kept up by the in a multiple sense profit-generating business of private loans, known as the financialization of everyday life. That also falls beside my point here. My point is purely speculative. If in negative price we see the potency of a lack of demand to bring everything to a halt, a negative price is still not a negative value. It is an instance of saying: no, I undemand this product to such a degree that you have to pay me personally to accept it. But it is not an instance of saying: no, this product of yours is positively destructive, I want it to cease to exist.

For such a negativity there is not even a technical term. Let us invent one: "dnamed" (demand in reverse). Presumably, people in general dnamed air polluted by the burning of fossil fuels. Presumably, people dnamed a climate change that will cause unprecedented flooding of enormous cities – that will in fact make of much of habited land on planet Earth new Atlantises – climate change that will cause havoc in agriculture and food production, that will, in short, make civilization as we know it impossible. Presumably it is the case that people dnamed implications and consequences of the deals they have to close all the time. Isn’t it curious, a sign of a certain impotence, that the very important human capacity to discern what is negative has no role to play in the market economy, other than indirectly? Isn’t it curious that the strongest forces of the planet are externalities to the market mechanism?

If I have money and am a human being with that phenomenon which we call a will, then I can make my (positive) preferences felt on the market; I can get what I want. But I cannot tell it what I do not want. If I have no money, nothing I will can be registered at all, but for indirectly, as the silence of lack of demand. Which, as we have seen, in its negativity maybe a louder silence than one might think. If I am an ocean, or a forest; or, if I am a honey bee, or a future humanity; if I am the generations past, the dead which form the condition of possibility of the present; or if I am God: then the market is blind to what I want. I am an externality.

I say: let us play with the thought of a negative theory of value. In multiple ways. As a theory of negative prices, of the disruptive force of lack of demand. As a theory of negative values, of demanding to no longer have to play the game of supply and demand in relation to things we do not want. And perhaps most importantly, and most difficult to imagine: as a negation of value as such – let us play with the thought of not evaluating at all, of resting for a bit from the choosing and weighing pro’s and con’s. Let us play with a thought of a divine perfection which dissolves the hierarchization implied in every evaluation, a perfection just about to transform everything into precious valuelessness.

Rosa